Digital Acceleration Driving Transformation in the KSA Health Tech Sector

The KSA Health Tech Sector is undergoing rapid evolution, backed by Vision 2030, public-private partnerships, and increased healthcare digitalization. According to Ken Research, the market is projected to reach over SAR 9.4 billion by 2027, expanding at a CAGR of approximately 14% during the forecast period. Telemedicine adoption, AI-based diagnostics, and electronic health record (EHR) integration are redefining healthcare delivery across the Kingdom.

Segmentation Illuminating Core Dynamics in the KSA Health Tech Sector

The market is segmented across technology types, service models, and end-user segments to better understand ecosystem dynamics.

Technology Segments: The sector includes telehealth platforms, hospital information systems, wearable tech, mHealth apps, and health analytics software. AI and blockchain are gaining traction in diagnostics and record-keeping.

Service Models: Includes B2B offerings like SaaS for hospitals and clinics, and B2C platforms like online consultations, e-pharmacies, and remote monitoring.

End Users: Hospitals, clinics, insurance firms, fitness providers, and consumers all use digital tools to access, monitor, and manage health services.

Learn more about digital progress in the UAE Health Tech Industry by reading the comprehensive sector report from Ken Research.Challenges Slowing Momentum in the KSA Health Tech Sector

Despite structural reforms, several barriers continue to impact the pace of digital health adoption.

Data Privacy and Integration Issues: Multiple health systems and databases lack interoperability, creating barriers in seamless information sharing and EHR standardization.

Regulatory Complexity: Unclear licensing, telemedicine policies, and cross-border data regulations hinder the growth of health tech startups and investments.

Limited Digital Literacy: Older population groups and rural patients face challenges accessing digital healthcare services without proper onboarding support.

Funding Constraints for Startups: Despite government support, early-stage health tech ventures struggle to secure sustained investments and clinical validation.

Explore funding dynamics and roadblocks in the Indonesia Health Tech Sector through Ken Research’s market insights.Opportunities Creating a High-Growth Trajectory

Several transformative opportunities are opening new frontiers for growth and innovation in Saudi Arabia’s health tech industry.

Vision 2030 and Government Initiatives: Projects like the National Health Information Center and Seha Virtual Hospital are accelerating digital transformation.

AI and Predictive Analytics: AI is being deployed in imaging, triage, and remote care. Predictive tools help hospitals optimize capacity and personalize treatment.

Wearables and IoT Integration: Connected devices for blood pressure, sugar levels, and ECG monitoring are growing in consumer use and clinical relevance.

Health Insurance Tech (InsurTech): Platforms enabling digital policy management, claims, and wellness rewards are gaining popularity among payers.

To understand how these trends compare regionally, read the Vietnam Health Tech Sector report curated by Ken Research.Key Players Driving the KSA Health Tech Sector

Leading global firms and local innovators are shaping the competitive landscape through strategic collaborations and digital-first healthcare delivery.

Altibbi and Okadoc: Pioneers in teleconsultation and appointment booking, partnering with major healthcare providers and insurers.

Sehhaty and Mawid: Government-backed apps facilitating access to health records, test results, and doctor consultations for millions of citizens.

Vezeeta and Clinicy: Regional platforms offering cloud-based clinic management, pharmacy integrations, and telemedicine support.

Philips, GE Healthcare, Siemens Healthineers: Global giants offering smart diagnostic tools, digital imaging, and hospital automation systems in KSA.

Explore regional competition in the Philippines Health Tech Sector with insights from Ken Research’s detailed market study.Competitive Landscape and Emerging Strategies

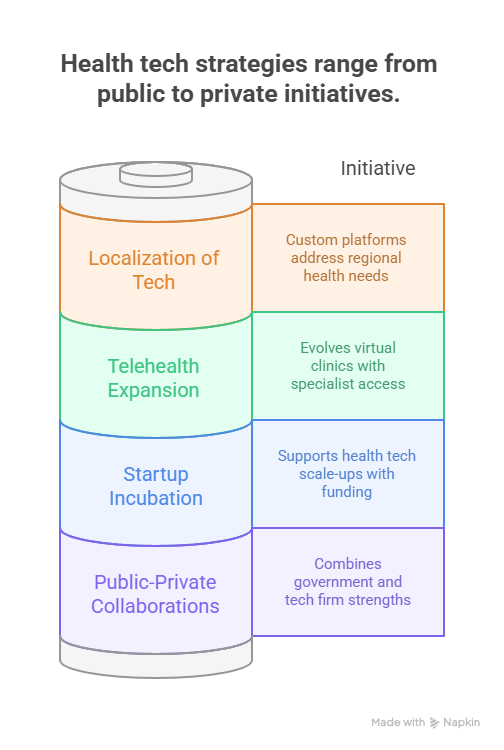

A mix of public initiatives and private innovation is reshaping competitive benchmarks across the Kingdom.

Public-Private Collaborations: Government hospitals are partnering with tech firms for digitizing medical infrastructure and capacity building.

Localization of Tech Solutions: Custom platforms addressing Arabic language support, cultural compliance, and regional health needs are growing.

Telehealth Ecosystem Expansion: From general practitioners to specialists, teleconsultation models are evolving into full-fledged virtual clinics.

Startup Incubation and Regulatory Support: Programs like Monsha’at and SDAIA are facilitating health tech scale-ups with funding, mentoring, and policy support.

See how India is building its startup ecosystem by referring to the India Health Tech Industry report by Ken Research.Conclusion

The KSA Health Tech Sector is poised for exponential growth, supported by state-backed transformation, demand for accessible care, and digital infrastructure upgrades. As players embrace localization, AI, and cross-sector partnerships, the sector will not only improve health outcomes but also reduce systemic costs. Stakeholders who adapt to evolving regulations, invest in tech enablement, and address inclusion challenges will lead this digital revolution in healthcare.